Does the Underused Housing Tax apply to you for 2022?

Below is a copy of an email sent by BDO Whistler (my favourite local accountants for everything related to taxes etc) with regard to the new Underused Housing Tax policy. You can read their email in detail (Thanks Joanna!) to determine if you need to file. Be aware that the deadline for filing this form is May 1, 2023

The link to the form is HERE

Subject: IMPORTANT – The new Underused Housing Tax may apply to you for 2022!

Date: 8 March 2023 at 4:17:41 AM GMT+9

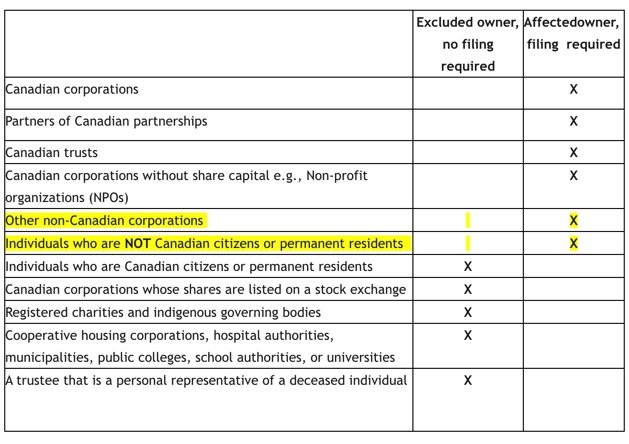

Dear BDO Client, A new federal Underused Housing Tax (UHT) has been introduced that may require a UHT Return filing no later than May 1, 2023, for the 2022 calendar year. The 1% UHT is intended to apply to non-residents on the value of underused residential properties in Canada but also creates filing obligations for many Canadian owners. Owners who are required to file a UHT return must do so for each property regardless of whether UHT is payable and failure to file a return carries significant penalties that begin at $5,000 for individuals and $10,000 for non-individuals (such as corporations, partnerships and trusts). The following table provides examples of:

- “Owners” that should have no filing requirement under these new rules (referred to as “excluded owners”);

- “Owners” that may have a filing requirement even where no UHT is owed (referred to as “affected owners”)

Please note that this list is not exhaustive and is intended for illustrative purposes only.

As an important non-resident client of BDO, we want to ensure that you are aware of your filing requirements and provide some general information on how the tax impacts non-Canadian owners of real estate in the resort community of Whistler, BC. The UHT does provide certain exemptions to non-Canadians such as vacation exemptions based on location and other criteria (Whistler is an eligible location), qualifying occupancy exemptions (such as but not limited to long-term rental leases of a property for appropriate durations), and a few others. Each exemption has certain criteria that needs to be carefully considered for eligibility. Short-term rental use is NOT a qualifying occupancy eligible for exemption, which means that an owner may need to be eligible for a different exemption if they own residential property to avoid paying the tax. However, to have a filing obligation under the UHT, the property owned must be a “residential property”.

From a Whistler resort perspective, there are different types of short-term resort properties, some of which might not be residential properties that are subject to the UHT. This is an important distinction, because it means that the property is out of scope of the UHT and the Owner would not have to file a return in respect of the particular property, as opposed to having to file a UHT return and then rely on an eligible exemption to avoid paying the tax. The filing position is not without risk. If a mistake is made in this assessment, late filing penalties would apply to any unfiled returns, which never go statute barred. And if no other exemptions were available, the 1% tax itself could be due. So it is critical that you obtain advice from BDO who is knowledgeable in this area to assist with your assessment.

For those who own a property in a Whistler Phase 2 property (typically full service hotels like the Westin, Four Seasons, Pan Pacific etc added by Denise) the risk is more limited, as these properties are usually hotels and contain restrictive covenants that require short-term accommodation use, which arguably make them unavailable as a place of residence. Hotels are specifically identified as an example of a property that is not residential in their published guidance in UHTN1.

For those with Whistler Phase 1 properties (air bnb rental permitted added by Denise), stand-alone homes, or other properties, the risk is significantly higher as the facts related to the specific use and rental activity will be very important in the determination of whether the property is primarily residential or primarily commercial. There may also be other considerations including the current or desired GST status of your property (commercial or used residential) as you determine your eligibility for the non-residential filing position or future decisions on how you use your property to manage UHT and/or GST outcomes.

CRA has also indicated that starting in 2023, when non-residents apply for clearance under section 116 because they have sold their Canadian property, they will inquire and/or audit UHT filings for completeness before issuing clearance.

Final Comments and Next Steps We understand that this new tax is a surprise for many, and that the late implementation / guidance from our tax authorities has made it impossible to plan ahead for 2022. We at BDO are here to help and would be pleased to assist you with one or more of the following:

- Determine the likelihood of your property being a residential or non-residential property in 2022 and the related filing requirements

- Confirming whether you must file a return in respect of residential property in Canada

- Obtaining the required Business Number (BN) or Individual Tax Number (ITN) required to file a return if you don’t already have one

- Preparing and filing your UHT2900 return, if applicable, at your request

- Discuss your future goals and what strategies you could consider to achieve them.

If you would like to engage us for any of these services, please respond to this email before April 1, 2023. We ask that you direct all requests to Whistler@bdo.ca rather than an individual, so that we can manage workload and track requests and responses. Once your request has been received, we will provide you with an engagement letter and fee estimate. It is very important that we receive signed engagement letters before we provide advice and we appreciate your understanding in this manner. We will also be asking clients to provide written acknowledgement that they understand and assume risks related to filing positions. We have also included additional resources below, which you may find helpful.

RESOURCES Canada Revenue Agency’s (CRA) website that explains the tax in further detail

Current BDO publications (additional publications may follow):

BDO's Underused Housing Tax Webinar

BDO webinar presentation material PDF

Underused Housing Tax Program: Considerations for Canadian Corporations, Partnerships, and Trusts

How the Underused Housing Tax May Affect Owners of Residential Property in Canada

The Underused Housing Tax and Your Farm Operation,

The information in the communication is current as of February 20, 2023.

This communication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The communication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact BDO Canada LLP to discuss these matters in the context of your particular circumstances. BDO Canada LLP, its partners, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this communication or for any decision based on it.

BDO Canada LLP 202-1200 Alpha Lake Road Whistler BC V8E 0H6 Canada Tel: 604 932 3799 Fax: 604 932 3764 www.bdo.ca EMAIL whistler@bdo.ca

Thank you BDO for letting me share this information.

Denise

Posted by Denise Brown on

Leave A Comment