BC Assessment Property Values Released

Posted by Denise Brown on

IMPORTANT NOTICE

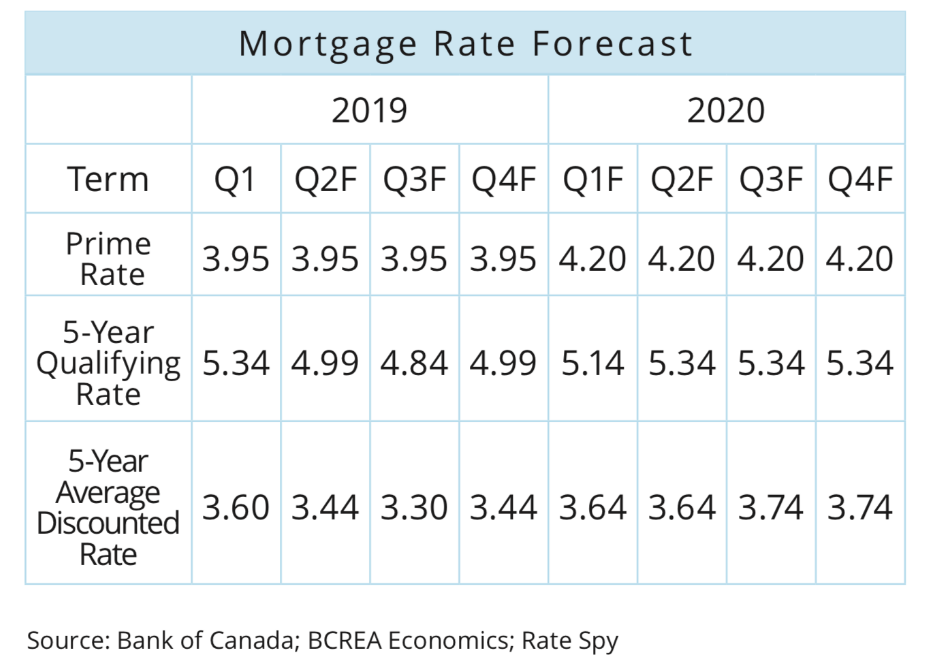

The BC Assessment Authority released their assessed values on Whistler properties earlier than anticipated. The assessed values are the source of many wrong decisions that can cost homeowers a lot of money if not properly understood.

I am sure you have many questions that the BC Assessment office has already answered in easy to watch videos. The videos include:

- How BC Assessment assesses properties.

- There are multiple videos related to "Understanding the Relationship Between Property Assessments and Property Taxes" and how they determine the assessed value of your property based on market values of sales as at the July the previous year..

The link to the videos is HERE

On January 2nd, there will be more…

620 Views, 0 Comments

.png)